A Holistic Perspective on Measures E and B

Left: Grass Valley’s Mill Street renovation. Right: Burn scars off of Whispering Pines that have been left unattended for years while cosmetic renovations have taken priority.

The City of Grass Valley proposes another sales tax hike to voters, Measure B, which will add 0.375% to the 1% sales tax passed in 2018 as Measure E. If passed, the sales tax in the City of Grass Valley will total 8.875%. With revenue from Measure E amounting to around $7 million a year, City leaders believe an additional tax hike is necessary to pay for a higher level of service of fire prevention and response.

I visited Grass Valley City Hall last week and talked to Grass Valley City Manager Tim Kiser. He explained that he views revenues from Measure E as a gift from the public and intends to use them faithfully. Kiser was helpful and forthcoming. After our conversation and reviewing the documents he provided, as well as talking to local business owners, I have made the following observations.

I have found that the Measure B ballot language is incorrect and misleads voters, that the City has ample sales tax revenue from Measure E, that City manager Tim Kiser once opposed general sales taxes, and that Measure E funds could be used for wildfire risk mitigation at the public’s direction.

Measure B Ballot Language Misleads Voters

The City of Grass Valley stated on the ballot that the expected revenue from Measure B is $3.4 million a year, when in fact the Measure would only raise $2.55 million. This means that voters are led to believe that the measure will raise nearly a million dollars more than it really will be able to raise.

The City used a number from an old proposal instead of the correct amount

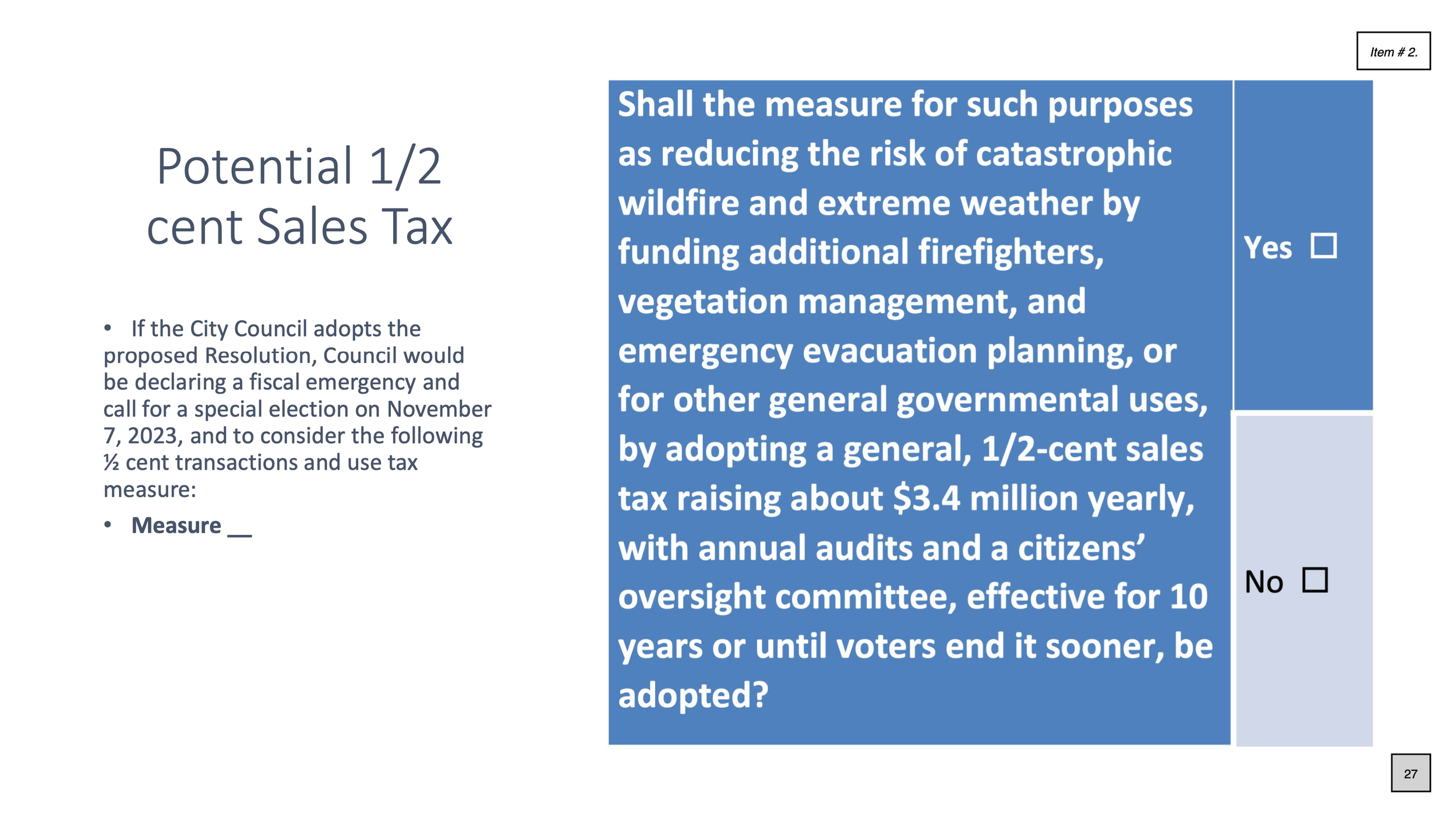

The City originally contemplated a 0.5% sales tax increase with Measure B, which would have raised the sales tax to a square 9%. At this rate, City Council documents from October 2, 2023 show that they anticipated an annual revenue of $3.4 million. A presentation from the City Council meeting packet includes a draft of the ballot language (below):

Excerpt from a past City Council presentation proposing a 0.5% sales tax increase, resulting in an estimated $3.4 million yearly. Measure B, however, is a proposed 0.375% sales tax increase, resulting in $2.55 million yearly.

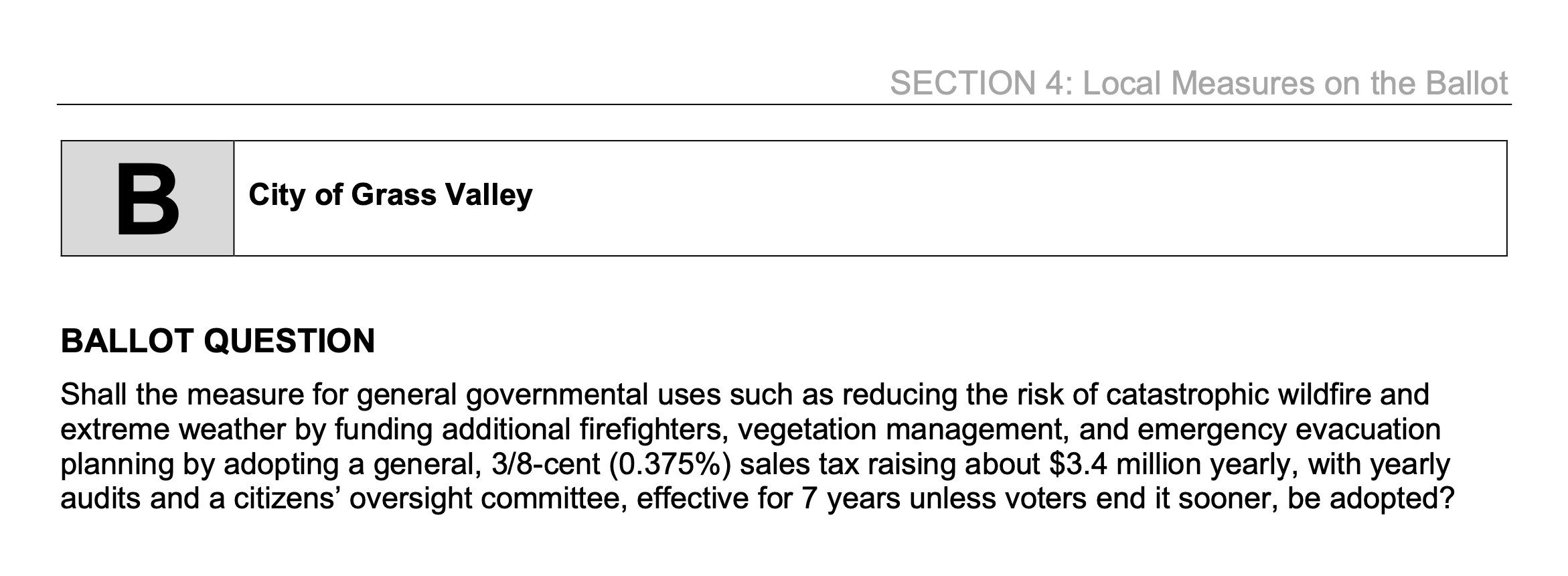

However, the city decided to reduce the proposal to a 0.375% tax increase, and did not adjust the expected revenue downward when placing Measure B on the ballot:

Screenshot of the March 5, 2024 ballot question, which proposes a 0.375% sales tax increase, but states the revenue that would be earned from a larger (0.5%) sales tax increase.

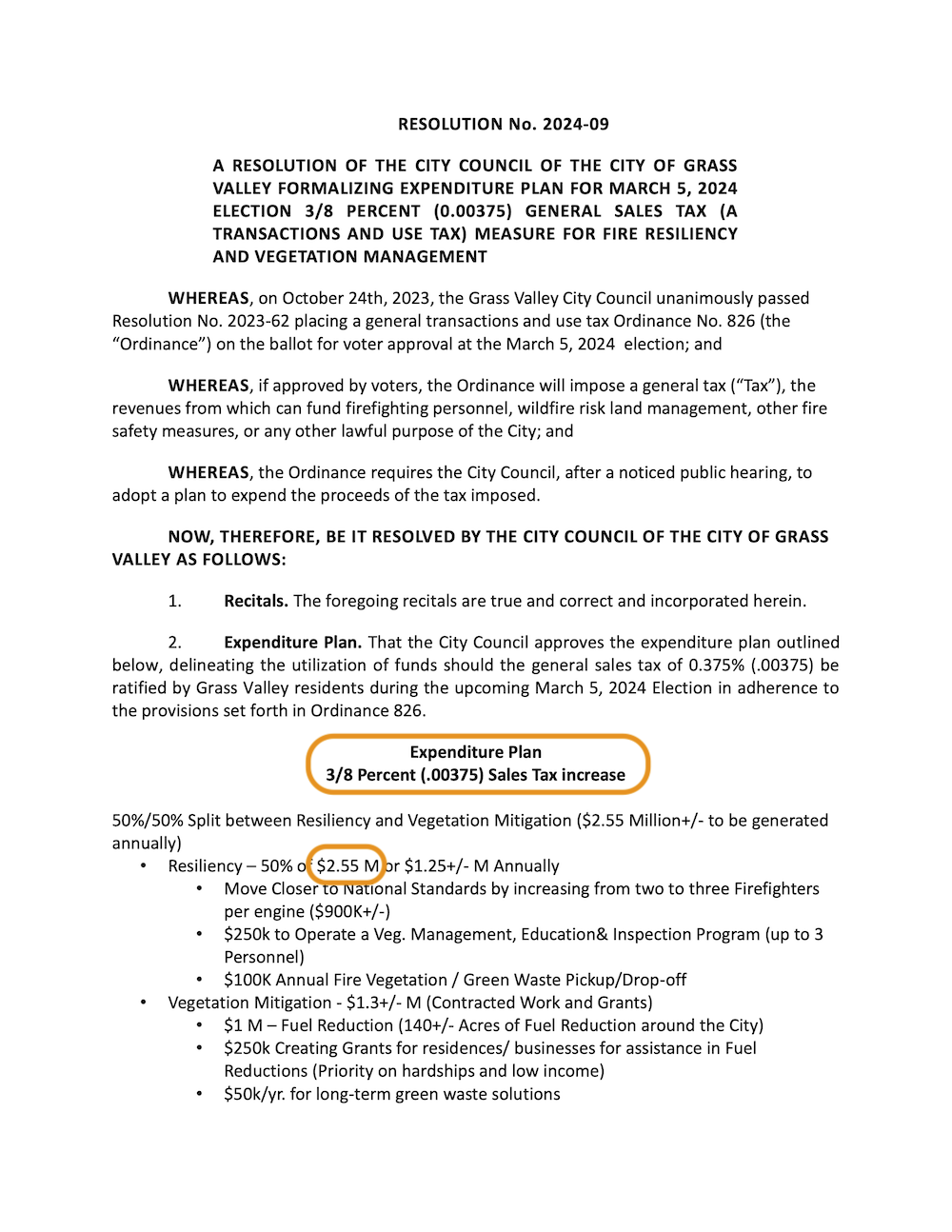

The City approved an expenditure plan for Measure B on February 13th. The plan details that at the revised 0.375% sales tax hike, the expected annual revenue is not $3.4 million, but $2.55 million:

City of Grass Valley Resolution No. 2024-09, which adopts an expenditure plan for Measure B

It is hard to believe that city leaders would intentionally mislead voters by claiming that the 0.375% tax increase would generate more revenue ($3.4 million) than their own expenditure plan forecasts ($2.55 million). At this point, with many people already casting their ballots in early voting, the City needs to make a public correction to inform the voters that the revenue figure in the ballot language is much higher than City leaders anticipate.

Why aren’t Measure E funds sufficient?

Was the city justified in declaring a fiscal emergency in order to put a tax increase on the ballot, while at the same time using Measure E funds to dramatically revamp Mill Street and local parks, when the threat of fire is so high? The City contracted Dudek Engineering to do a Wildfire Risk Assessment. The study, dated January 2024, details that “77% of development areas within the assessment area were classified as either High, Very High, or Extreme relative wildfire risk.” The conditions that contribute to this risk are a result of decades of vegetation growth and accumulation.

According to the City, total revenue from Measure E (previously Measure N) totals almost $40 million. With the fire risk so high, voters may wonder why some of the tens of millions resulting from Measures N and E were not put towards vegetation mitigation since the city started collecting the sales tax revenue in 2015.

There is a pattern developing of declaring an emergency to raise sales taxes that will go into a general fund. The City has declared an emergency in order to justify sales tax hikes before. Measure E was sold to voters with the following language:

“The City faces a public safety emergency and needs to increase the City’s police services to combat drugs, vagrancy, and crime.”

Legal document used to place Measure E on the ballot

City Manager Tim Kiser opposed Nevada County’s Measure V because it was a general tax

A local business owner who prefers to remain anonymous has come forward to share that on August 2, 2022, Kiser gathered business owners together to express his view that they should vote no on Measure V. The business owner shared the email which called for the meeting where “Tim told us to vote no because there was no sunset clause and it went into a general fund and how the money could be spent anywhere because of that. I knew nothing about a sunset clause or a general fund until this meeting.”

Email from City of Grass Valley Administration to business owners calling for an in-person meeting on Mill St. to discuss Measure V.

Measure E has been used for personnel costs such as unfunded pension liabilities, but not wildfire prevention

In keeping with the “general tax” status, funds from Measure E are used for any “lawful purpose of the city” including unfunded pension liabilities for safety (fire and police) employees. The City has been making payments ranging from $90,000 to $190,000 a year since 2018 categorized under CalPERS UAL amortization for safety members (police and fire). UAL stands for “Unfunded Accrued Liability”, and according to a CalCities report, is a “measure of the funding shortfall of each agency’s pension liability” that “should be viewed as a ‘payment plan for past due bill’”.

Questions that come mind:

How much money do we lack to fully pay for our police and firefighter pensions?

If we have more economic pressures (high inflation, stock market downturn, recession), will the city just keep increasing taxes on its citizens to keep up - or is there another plan?

Operating on a Handshake

While City leaders seem to have the best intentions when it comes to how revenues from Measure E are used, founding documents for Measures E and N confirm that the legal use for these funds is very broad. Voters who passed Measure E in 2018 saw language that led them to believe that the tax revenue would be used for safety and recreation, when in fact it could be used for any purpose:

“It is a general tax and its proceeds could fund police, fire, streets, sidewalk maintenance and repair, and park improvement and recreation services, or any lawful purpose of the City.”

However, according to the Ordinance 795 passing Measure E, specific language about police, fire, and parks was removed:

“The proceeds of the taxes imposed by this ordinance may be used for any lawful purpose of the City, as authorized by ordinance, resolution or action of the City Council. These taxes are not special taxes within the meaning of Article XIII C, section 1(d), but are general taxes imposed for general government purposes.”

The City has confirmed that Measure E did not require a spending plan, but provided a copy of the spending plan for Measure N from 2012 which also served as the framework for Measure E spending. The plan focuses on police and fire staffing and vehicles, as well as street maintenance and repair, in keeping with the original intent of both Measures N and E.

We Don’t Need Another Tax Increase—the answer lies in Measure E

People concerned about fire risk who want to see funds spent on vegetation mitigation have another option. They do not have to vote for another sales tax increase. The answer lies in Measure E. Since Measure E is indeed a “general tax” and the funds can be spent on any lawful purpose, the community can urge City Council to pass an ordinance revising the use of the funds to include spending on vegetation abatement. Such an ordinance would also inform the Measure E Citizen Oversight Committee on a revised framework for acceptable uses for the funds (which are already earmarked for “fire”) to include vegetation mitigation projects.

As detailed above and on the City’s website, Measure E now brings in about 7 million dollars a year:

Revenues for Measures N and E, 2015-present

Moreover, according to the most recent financial statement, the “Measure E Fund total fund balance was approximately $4.4 million.”

Millions of sales tax dollars have come in every year since Measure N was passed in 2015 and then Measure E in 2018, and the risk of wildfire is common knowledge. Imagine if the City had already spent even a fraction of the funds from Measures N and E every year on vegetation mitigation. The public would see a much different landscape surrounding the city, and some homeowners could have already benefited from grants to help them remove dangerous trees or brush from their property.

Funds that were spent on cosmetic renovations such as the Mill Street Plaza and some of the city parks could have been spent on brush and tree maintenance. Consider these other expenditures of Measure E funds and ask yourself if you would have opted to spend some of those dollars on fire hardening instead (figures are from the City of Grass Valley Fiscal Year 2021-2022 Final Budget Measure E Fund):

Lyman Gilmore Field Improvements: $1,619,792

Mautino Park Turf Replacement (estimate): $300,000

Condon Parking Lot Improvement: $650,000

Minnie Park/Memorial Park Projects: $557,687

City of Grass Valley Capital Expenditure Detail for Measure E

Instead, the City opted to ignore the need for vegetation mitigation, declare a fiscal emergency to place the proposed sales tax hike on the March 5th ballot, and then present the Dudek study on wildfire risk just in time for early voting.

Citizen oversight need not be limited to specific committees or meetings. In a time when we are seeing our household budgets tighten due to inflation, it is only natural for citizens to ask the City to modify the budget for the millions already coming in from current local sales tax revenue to include more fire prevention related costs.